Stock in Focus: Qantas (ASX:QAN)

CommSec

CommSec

XX September 2025

Will the Flying Kangaroo continue moving ahead in leaps and bounds?

The Queensland and Northern Territory Aerial Services Limited, better known by its acronym QANTAS, has been flying around and beyond Australia since 19201. The world’s third-oldest extant airline (behind KLM and Avianca)2, Australia’s de facto flag carrier has been available for trade on the ASX since 1995, when it was fully privatised and listed3.

Although the Flying Kangaroo remains one of the country’s most globally recognised brands, in the past decade its once-vaulted reputation has taken a few hits – some beyond its control, but several self-inflicted.

A distressing decade

The airline industry was of course decimated by the grounding of travel triggered by the COVID pandemic of 2020/21. But on 18 August 2025, the Federal Court fined Qantas $90m for illegally outsourcing more than 1,800 ground handling jobs during the pandemic – the largest-ever fine imposed for breaches of the Fair Work Act4. This came less than a year after the airline paid a $100m penalty – the biggest ever imposed by the ACCC as part of a settlement – for selling thousands of tickets for flights it had already cancelled5.

The 2025 financial year also saw the demise of Jetstar Asia, Qantas’ Singapore-based low-cost subsidiary, in the face of what Morningstar described as “elevated competition and elevated input costs including airport fees”6. FY25 also saw the Qantas board slash the payout to former chief executive Alan Joyce, who prematurely left the airline in September 2023, by almost $10m7. And in July, Qantas had to contact 5.7 million impacted customers whose personal data was compromised by a data breach cyber incident8.

Yet despite a tumultuous financial year, on 28 August 2025, Qantas announced a net profit of $1.61bn in the 12 months to 30 June, up 28% on FY249. This result, the airline’s best since its record post-COVID FY23 bounce-back, helped send Qantas shares to a record high of more than $1210.

Qantas Group CEO Vanessa Hudson attributed the healthy result to “continuing strong demand across all market segments, combined with our dual brand strategy… Qantas and Jetstar carried four million more customers during the year, while our Loyalty business grew as frequent flyers engaged with the program more than ever before.

“Jetstar had a standout year, with its fleet renewal providing a significant boost to earnings. In a high cost of living environment, Jetstar continued to provide value for customers,” Hudson said11.

Fleeting love

After many years of letting its fleet age with minimal upgrading, Qantas has kick-started an aggressive renewal strategy by investing in dozens of new-build, mostly Airbus narrow- and wide-body aircraft.

Project Sunrise, first announced in 2017 but delayed by the pandemic, will, when completed, see 24 brand new A350-1000s flying some of the world’s longest non-stop international routes, including Sydney-London and Sydney-New York12. Airbus is expected to start delivering the first Project Sunrise planes to Qantas, which will eventually replace the Flying Kangaroo’s 10 A380-800 mega-jets, from October 202613.

Domestically, Qantas’ regional subsidiary, QantasLink, is already flying several new A220 jets that have replaced its retired fleet of Boeing 717s14. The QantasLink A220 will make its international debut when it begins flying Brisbane-Wellington in February 202615.

And on the same day it revealed its FY25 earnings, Qantas also announced an order for an additional 20 Airbus A321XLR aircraft on top of the 28 it already has on order16. This game-changing single-aisle jet won’t just eventually replace the airline’s workhorse fleet of domestic Boeing 737s; its extended flight range of up to 8,700km – about 3,000km more than the B737 – and increased fuel efficiency opens up a whole new range of mid-haul Asia routes that aren’t otherwise profitable using twin-aisle jets17. Hudson has identified Perth-India and Adelaide-Singapore as hypothetical examples18.

A dozen new A321XLRs are also en route to Jetstar for 2027, along with 38 other A321 and A320 variants19.

It’s not all one-way traffic of Airbus planes replacing Boeings; Qantas has also ordered 12 new 787 Dreamliners to eventually replace its A330s20.

“Our strong financial performance is enabling significant investment in new aircraft and customer initiatives, helping deliver better operational performance and customer satisfaction across both airlines,” Hudson said21.

All up, Qantas’ total firm aircraft order stands at 214, with 32 delivered as of 30 June22. “We expect more than AUD 20 billion in gross capital expenditure over the next five years, compared with about 11 billion in the last five,” notes Morningstar23.

Giving us the business (lounge)

Qantas’ flagship international business lounges in Melbourne and especially Sydney have an unenviable reputation of being among the world’s most disappointing, particularly when compared to other prestigious airline brands within Qantas’ own Oneworld alliance like Cathay Pacific and Qatar Airways24. But May 2025 saw the opening of Adelaide Airport’s first ever Qantas Domestic Business Lounge, which has been positively received25.

Across the pond, a new and improved Qantas Auckland International Lounge is slated to open in early 2026 – welcome news for eligible passengers flying the airline’s busiest international route (from Sydney)26.

And closer to home, Qantas has committed to a multi-million-dollar makeover of its Sydney international business lounge to be completed by FY27 – although this is far from the first time this project has been promised!27

The commitment to quality new domestic and international lounges in key markets may offset some of the anger felt by Qantas’ Frequent Flyers, who in August saw their points devalued as part of the airline’s major overhaul of its loyalty program28.

So… about the stocks?

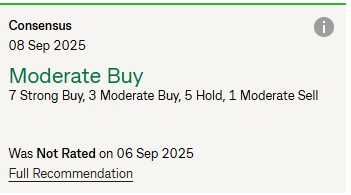

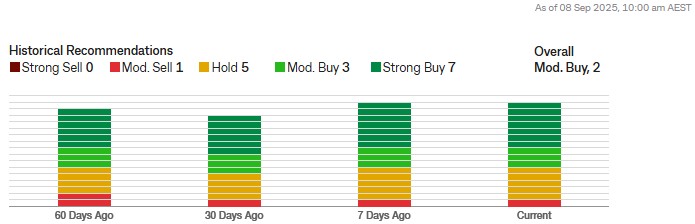

As of 8 September 2025, Qantas stock has a “Moderate Buy” consensus.

Morningstar takes a somewhat cautious approach to Qantas stock, highlighting a fair value of only $10.41 (as of 26 June), below the $12+ record the group hit on 28 August and the $11.80 it landed on at the close of 17 September29. Nevertheless, it also believes that “conditions are cyclically favourable for Qantas.

“Qantas’ earnings are highly leveraged to improving macroeconomic conditions and unrestricted air travel. The two-brand Qantas and Jetstar strategy provides flexibility to align capacity and costs with prevailing demand and economic conditions, without affecting the Qantas brand and service perception.”30

Morningstar also warns that “this share class has outperformed the broader universe over the past year. This outperformance may signify a bull trap, in light of other detractors from our model”.31